Penciler Overview¶

Penciler is a web-based, site-level, multifamily housing development feasibility tool created by UrbanSim in collaboration with the Mayor’s Office of Housing and Community Development in San Francisco. Penciler is currently available in the cities of San Francisco, Berkeley and Oakland, CA, Vancouver, BC and Denver, CO. Penciler analysis is currently available for sites between 3,500 and 120,000 GSF in these cities.

Intended for use during the acquisition phase of the multifamily housing development process, Penciler gives you a quick picture of the feasibility of a site from a building program and financial perspective. Drawing on local site data, planning codes, and building codes, you can quickly generate many different building options on the same site and compare costs and sources of funds for each option, helping to better inform site acquisition and site redevelopment decisions.

For each potential development site you navigate between two interconnected tools: Buildings and Pro Forma Analysis. The following is a description of each of these tools and their interconnected functionality.

Building Options¶

The core of Penciler is an algorithm developed by UrbanSim that uses constrained optimization to maximize the unit count on a site given the zoning constraints of the site and the building program requirements of the user. The algorithm optimizes building typology and unit count given all the requirements of the user, including unit mix preferences. The building layouts generated are not intended to replace an architectural floorplan but rather to give you a sense of what unit count and mix would be possible on the site during a site feasibility analysis.

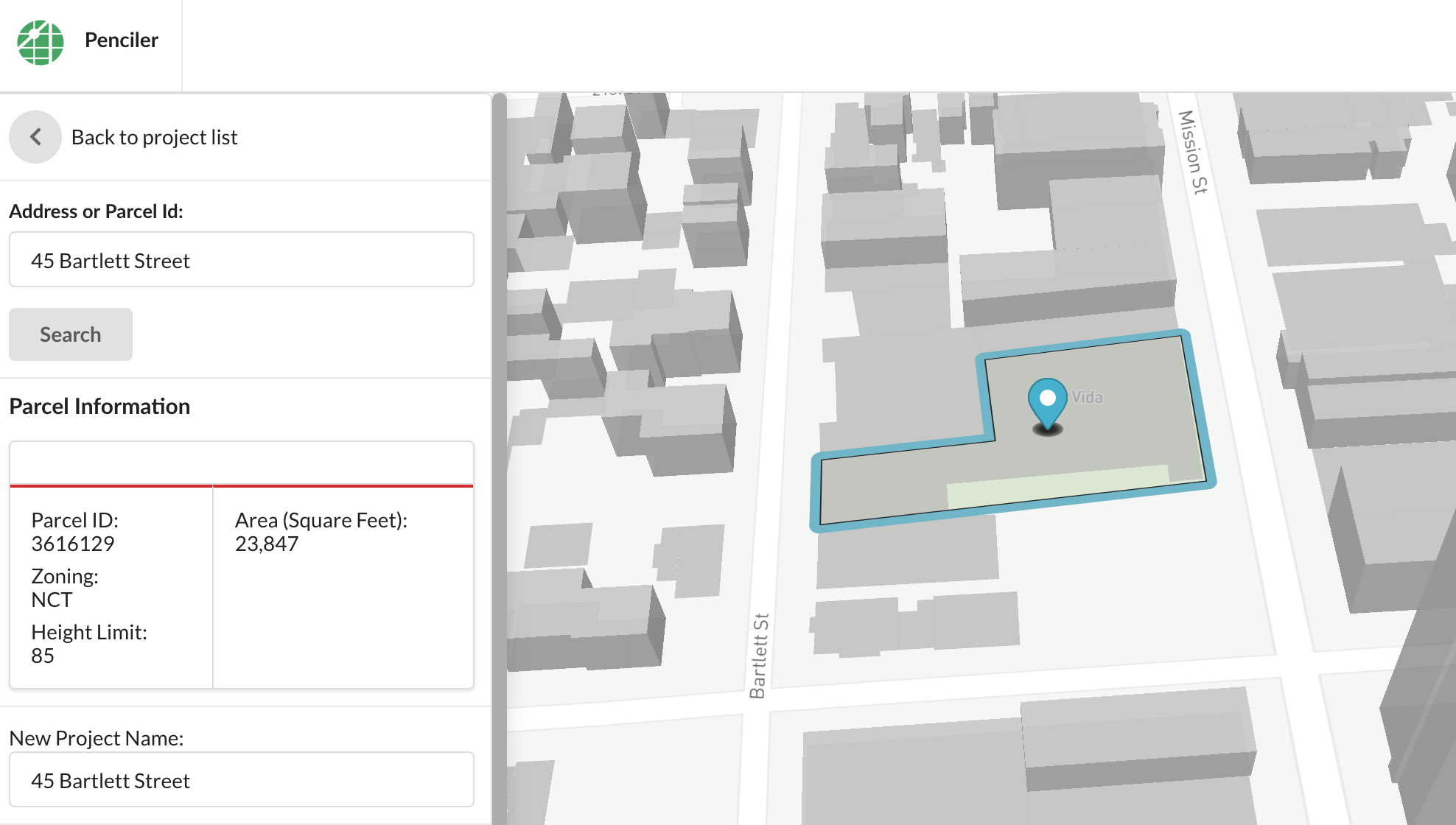

You start a new project by either entering an address or selecting the parcel directly in the map, which connects to information on the site location, zoning, maximum allowable building height and parcel geometry.

When you add a building option, you can see and edit additional zoning constraints or add features like a density bonus. You can add building program requirements like unit mix and ground floor retail. The algorithm uses the following physical constraints and space requirements when laying out a building to maximize unit count, some of which can be edited by the user in the zoning and program forms:

- Zoning constraints:

Maximum allowable building height

Effective maximum allowable building height (accounts for density bonuses or height modifications)

Front setback (% of lot or sf/m)

Rear yard setback (% of lot or sf/m)

Side setback (% of lot or sf/m)

Minimum common open space per unit (gsf/m per unit)

GSF of lot per unit (density)

Maximum floor area ratio (FAR)

Podium height and lower tower stepback (bulk requirements)

Parking ratio (spaces per residential unit)

- Building code requirements:

Minimum hallway width

Minimum corridor width (refers to the minimum external distance between two building corridors)

Residential ceiling height (floor plate to floor plate)

Minimum number of stairwells

Minimum number of elevator banks

Minimum distance from a residential unit to a stairwell

- Building program (space) requirements:

Unit mix (% of units for each unit type)

gsf/m per unit type

Accessible roof

Ground floor commercial retail (gsf/m)

Multiple buildings

While many of the zoning constraints are auto-populated from a database of the physical constraints in the planning code, you can modify some of the above variables in order to understand the feasibility impacts of different program decisions. Further, if you tend to use similar building programs for different development projects, you can save different building program profiles to your account so that these space requirements are auto-populated from a dropdown menu in the future. The Buildings summary table allows you to compare different building programs for the site.

You can view both a 3D massing and 2D floorplan in the map from the buildings summary table.

Pro Forma Analysis¶

You can quickly enter a total development cost per unit, which includes land and acquisition costs, or build out a more detailed development cost pro forma on a cost per square foot basis.

- Development cost inputs:

Residential construction cost ($ per sf/m)

Commercial construction cost ($ per sf/m)

Acquisition cost

Parking construction cost ($ per space)

Impact fees per unit

Developer fee

Soft costs (% of hard costs)

The financial feasibility tool draws on the generated unit count and total development costs. Under Operating Period Assumptions you can input the following assumptions:

- Operating period assumptions:

Residential vacancy rate

Commercial vacancy rate

Operating expenses (unit per annum)

Expense inflator

Reserves (unit per annum)

Residential rent inflator

Commercial rent inflator

Laundry income (unit per month)

Manager’s unit

- Rent assumptions:

Residential rent per unit type

Utility allowances ($ per unit per annum)

Commercial rent ($per sf/m annum)

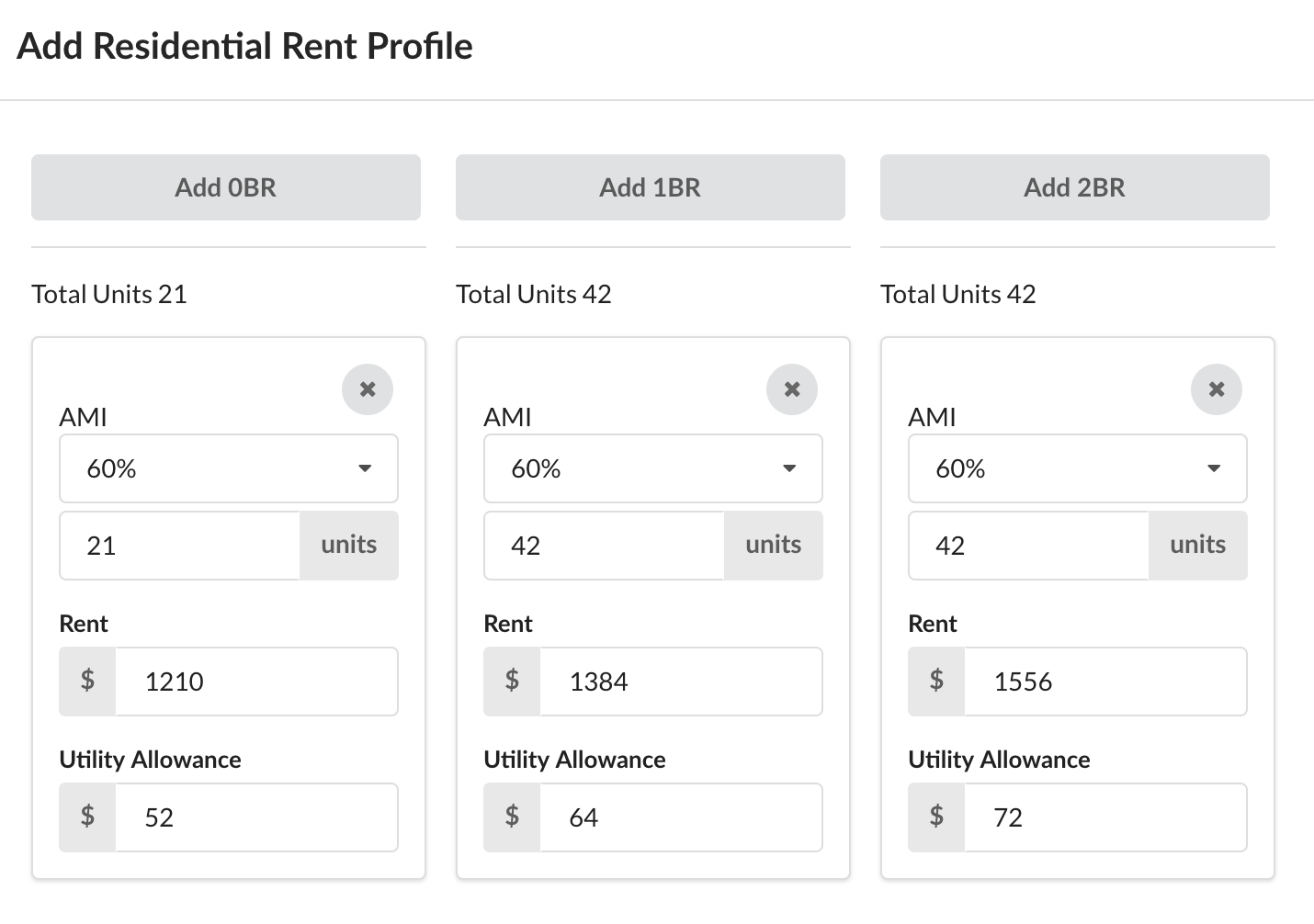

Update a residential rent profile by either entering market rate rents or breaking down the generated unit mix into different Area Median Income (AMI) levels (or both). A dropdown menu allows you to auto-populate local AMI-specific rents by unit type, but you can edit any of the values and input custom rents. You can download a 20-year cash flow .csv file that is automatically generated from the operating period assumptions.

Under Sources of Funds you can input various sources of debt and equity. You can generate a first mortgage based on a specified debt service coverage ratio as well as enter other sources of debt and equity. By indicating that you intend to use Low Income Housing Tax Credits, you can generate tax credit equity as a source of funds. This includes tax credit percentages updated monthly based on federal rates. You can indicate a basis boost for Qualified Census Tracts, Difficult to Develop Areas, and others.

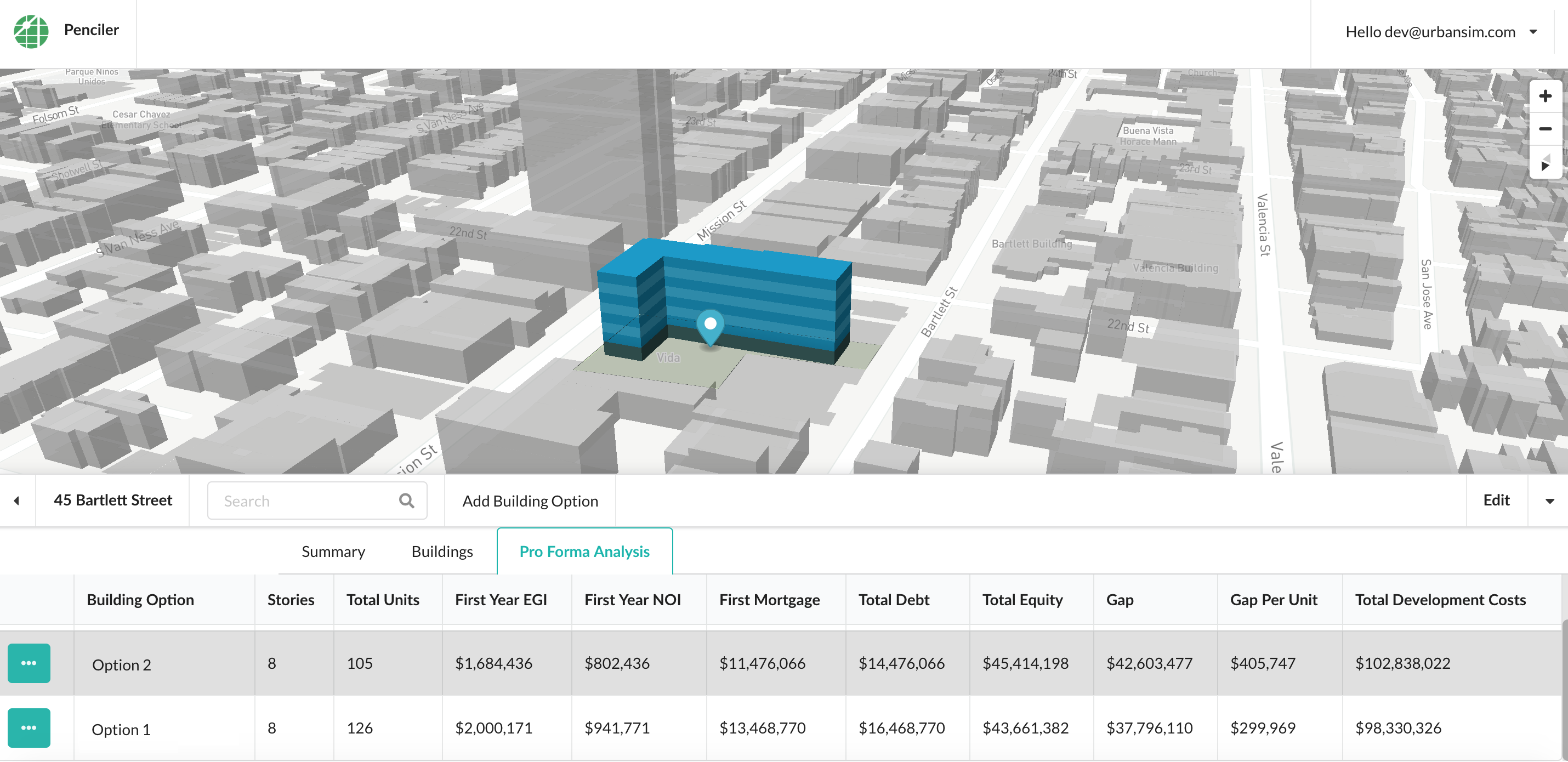

The financial feasibility table displays the gap per unit, allowing you to compare financial feasibility across multiple options on the same site.

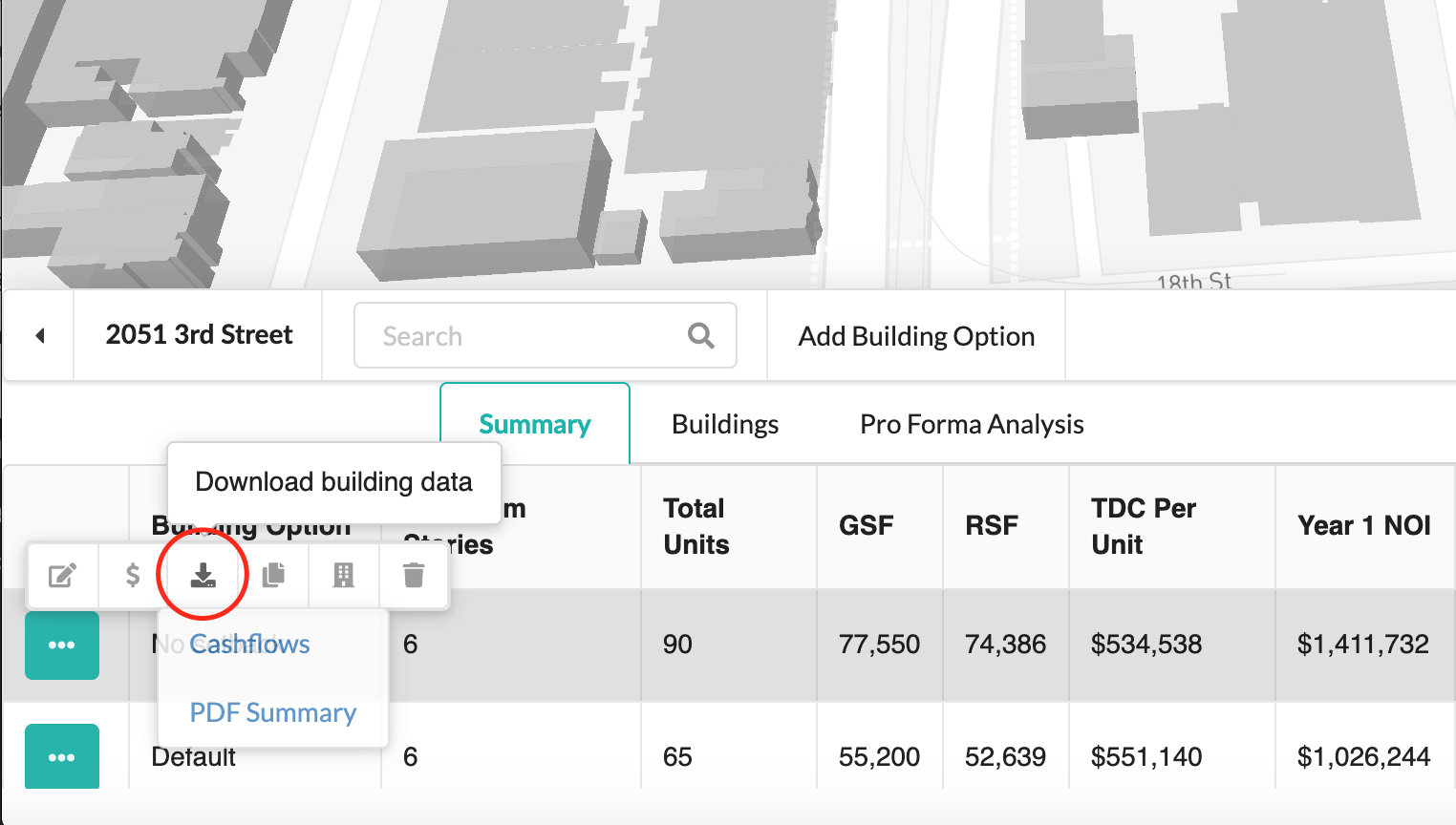

The Summary table gives you a quick picture of the feasibility of multiple building options on the site from a building program, development cost and financial perspective. From here you can download a 20-year cash flow for each building option as a .csv file. In addition, you can download a PDF summary of each building option.

Download a PDF summary or .csv file: